5 months ago I began a journey. What inspired this journey? Well, frankly, I was tired of owing money to everyone! It wasn't until I sat down and wrote everything out that I realized how much outstanding debt we had... 2 car payments.. a mortgage.. credit cards.. student loans.. personal loans for major home repairs we had to have. So I began creating this guy....

My new best friend.. my budget binder. What has little guy done for me? He has helped me pay off just a hair shy of $3,000 extra in debt in less than 5 months!

So what's in him that makes him so amazing?

In the beginning we have a zipper folder. I keep stamps, a calculator, a pen, highlighter, my checkbook, and payment books. Anything I need to pay my bills. The folder pocket I keep all my master copies and any bills I receive.

A breakdown of the rest:

A section for each of our loan debts; ie auto loans and student loans. I keep track of payments I've made, how much was due and how much I paid. This way I can see how much I have paid that is extra towards the principal.

Mortgage. This section is the same as my loan debt. I keep track of when payments are made, how much was owed, paid, and extra toward principal.

Savings. Simply a ledger to keep track of how much is in our savings.

Expenses. I have 3 pages in my expenses. Gas, Grocery, and Misc. Expenses. This way I can keep track of outgoing money.

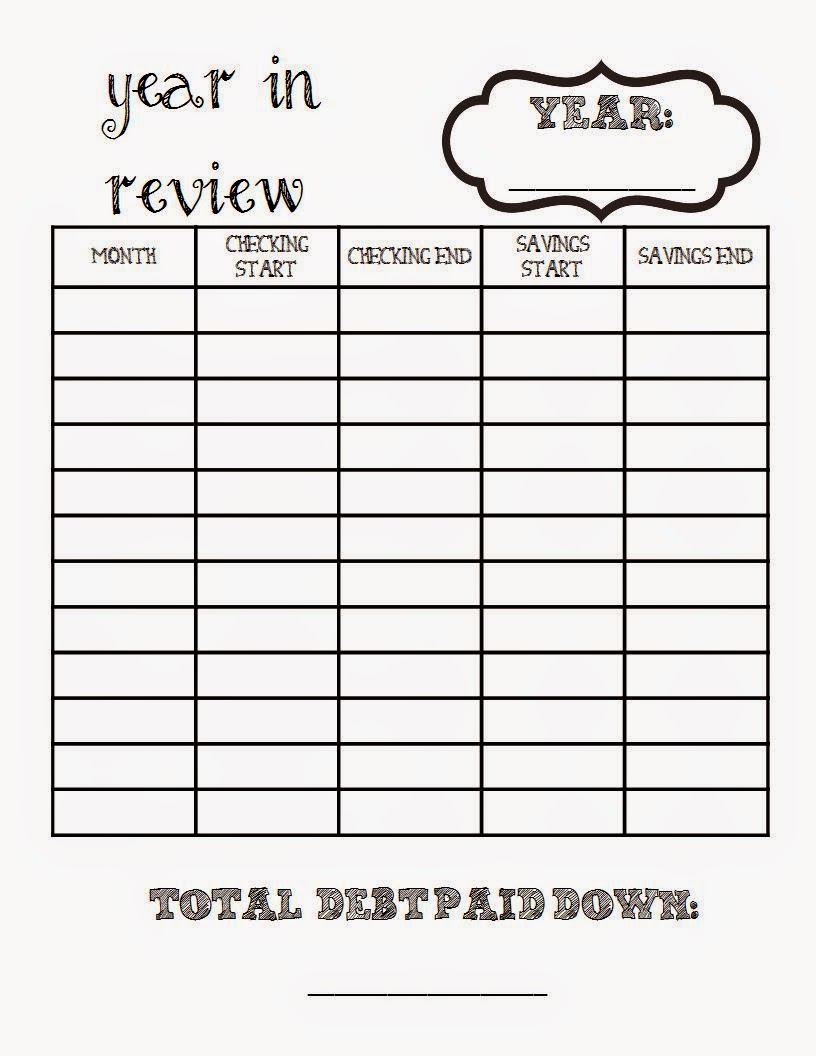

Yearly budget. This is just to keep track of checking and savings at the beginning and end of each month.

Outstanding debt. Here I keep a sheet for each credit card. Thankfully I'm down to one!! I keep track of all of my payments made. I also keep track of interest because that motivates me to pay faster!!! The first page of this section has an outstanding debt progress page. At the end of every month I go back and log how much extra was paid on credit cards, mortgage, or loans. This has been my motivator because I can see the progress I made!

Then we have the monthly budget. Here I break my bills down into sections: the first and the second half of the month. As I pay them, I put a check mark by them. Once they come out of my bank account, I highlight them.

I also have a monthly check in. Here I log twice each month. I keep track of income, total bills, total spent for gas, groceries, and misc. This way I can tell if we are staying within the amount we have set for each category.

Click each underlined section to get a free printable!